Written by Wandile Sihlobo, Stellenbosch University

South African agricultural exports were up for the third consecutive year in 2022, reflecting favourable production conditions and higher commodity prices. The export numbers for the full year have not yet been published. I have calculated the annual data for 2022 using quarterly trade export statistics published by Trade Map, a trade statistics portal developed by the International Trade Centre, the United Nations Conference on Trade and Development and the World Trade Organisation.

The major export crops continued to be maize, wine, grapes, citrus, berries, nuts, apples and pears, sugar, avocados, and wool.

These products have been the drivers of exports over the past couple of decades. In particular, fruit and wine have increasingly become the leading export products. These have driven a rise in the value of agriculture (and agro-processing) exports, which have averaged 11% of the South Africa’s overall exports, up from 9% in the decade before.

South Africa now exports roughly half of its agricultural produce in value terms. Citrus, table grapes, wine and a range of deciduous fruits dominate the export list. Increasingly, we are seeing the encouraging uptick in beef exports.

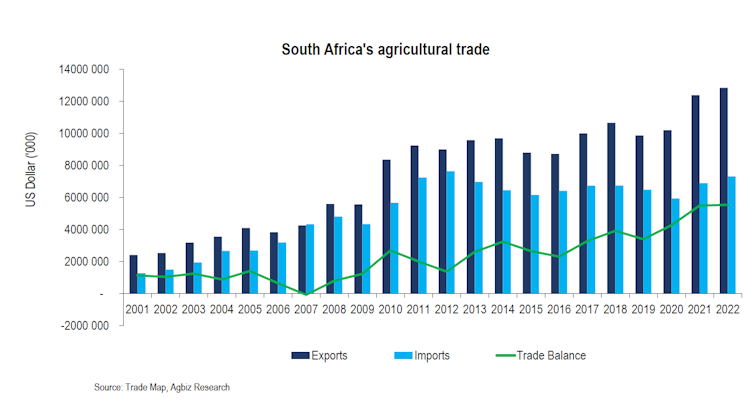

These robust exports have enabled South Africa to retain its position as a net exporter of agricultural products over time. In 2022, South Africa’s agricultural exports reached US$12.8 billion, up 4% from the previous year.

Imports, nevertheless, remain significant, averaging US$6.6 billion over the past five years. In 2022, the top imported products were rice, palm oil, wheat, poultry and whiskies. These originated primarily from Asia, the European Union, the UK and the Americas.

Based on my calculations, using Trade Map 2022 data, South Africa’s agricultural imports amounted to US$7.3 billion, up 6% from the previous year. Considering this import value against the export value of US$12.8 billion, South Africa’s agriculture realised a record trade surplus of US$5.5 billion.

In view of this, focus should now be on expansion of South Africa’s agricultural exports beyond its typical markets in the African continent, EU and parts of Asia, to new growth frontiers. There is growth in domestic production, and South Africa will require new markets for the expanding harvest.

The priority countries for expanding agricultural exports should be China, South Korea, Japan, the US, Vietnam, Taiwan, India, Saudi Arabia, Mexico, the Philippines and Bangladesh. All have sizeable populations and large imports of agricultural products.

Who is buying South African?

My calculations using Trademap data show that the African continent remains a leading market, accounting for 37% of South Africa’s agricultural exports in 2022.

These exports are concentrated within the Southern African Development Community region. But my recent research shows that South Africa’s agriculture export opportunities within the African continent will be limited due to structural challenges, preventing the agricultural sector from expanding its exports into untapped markets. This is despite the hope that’s been placed on the African Continental Free Trade Area.

Asia was the second-largest agricultural market, accounting for 27% of exports, followed by the EU, accounting for 19%. The Americas region was the fourth largest, accounting for 7%, and the remaining 10% went to the rest of the world.

Within the rest of the world category, the UK, historically South Africa’s major market for agricultural produce, was one of the leading markets.

The products of exports to these markets were primarily the same, with the African continent and Asia importing over two-thirds of maize harvests. Meanwhile, exports to other regions were mainly fruit and wine.

Asia has seen much faster growth in exports over the past six years, while the African continent and the EU have remained fairly stable.

Challenges

South Africa’s robust export earnings were achieved in the face of various challenges in ports and key export markets.

For example, at the start of 2022, logistical challenges in the port of Cape Town disrupted the exports of table grapes and other deciduous fruits. Thankfully, cooperation between Transnet and organised agriculture helped minimise the constraints, and opened up channels of communication that were critical for managing the flow of exports and attending to pressing problems.

The Durban port, which handles about 60% of the country’s exports and imports, faced fewer challenges than the previous year. As a result, citrus exporters faced a relatively better export season from a logistics perspective. The smoother flow of agricultural exports through Durban was also brought about by increased cooperation between organised agriculture and Transnet.

Credit should go to organised agriculture groupings, the government, Transnet and various logistical groups that worked tirelessly to ensure a flow of products to export destinations. While there are still many challenges within logistics, Transnet’s willingness to cooperate closely with the agricultural community has helped improve product flow.

South African exports also faced non-tariff barriers in some key export markets, such as China for wool and the EU for citrus.

China temporarily blocked South African wool in response to the outbreak of foot-and-mouth disease in South Africa.

This was a misstep on China’s part as there is already a framework for dealing with an outbreak of foot-and-mouth disease to ensure the safety of wool exports to China. Notably, the outbreak was on cattle, not sheep, which should have provided further comfort about the safety of wool exports.

China lifted the ban after about four months. However, it had already had a notable financial impact on South African wool farmers and exporting businesses. China accounts for just over 70% of South Africa’s wool exports.

For its part, the EU imposed protectionist measures on South Africa’s agriculture by changing its regulation on plant safety for citrus without notifying its trading partners in reasonable time.

The new regulation purports to protect the EU from a quarantine organism, “false codling moth”, by introducing stringent new cold treatment requirements, particularly on citrus imports from Africa, mainly affecting South Africa, Zimbabwe and Eswatini. This was a contentious issue, especially as South Africa had already put rigorous measures to control the moth, which the EU used as a pretext to restrict citrus imports from Africa.

Focus areas

Given that South Africa’s agriculture is export-orientated, the focus should be on maintaining smooth relations with existing critical export markets while searching for additional new markets.

This is particularly important in the context of growing tensions between the east and the west, specifically the US and China.

South Africa has to maintain open and friendlier relations with both groupings as the exports of agriculture are evenly spread across these regions.![]()

Wandile Sihlobo, Senior Fellow, Department of Agricultural Economics, Stellenbosch University

Photo by Kym Ellis on Unsplash

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Relevant Agribook pages include “Exporting“